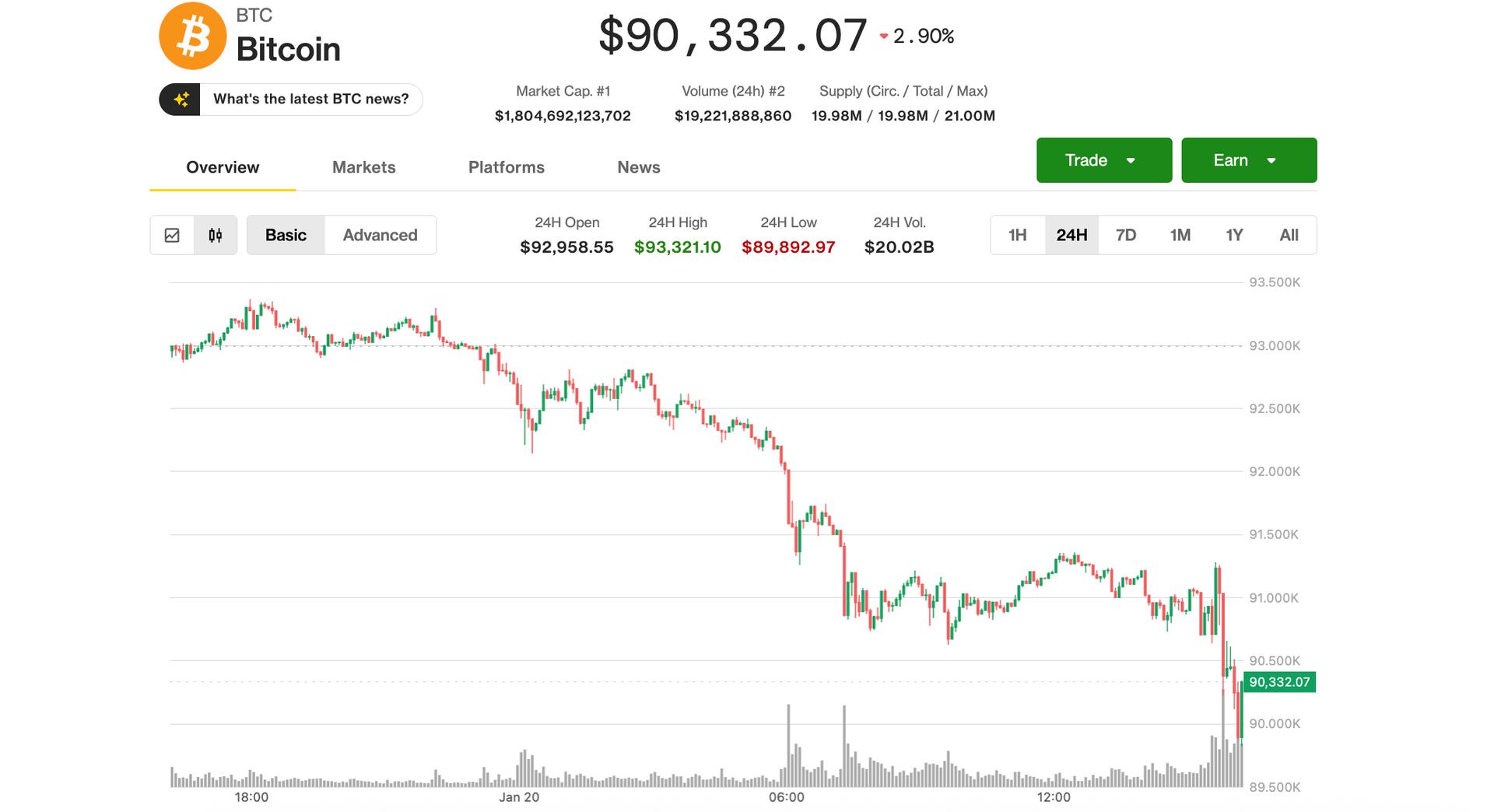

Current Developments: The cryptocurrency market is currently focused on the significant accumulation activities by Bitcoin treasury firm Strategy, which has recently crossed the 700,000 BTC threshold following a substantial $2.13 billion purchase. This buying pressure contrasts sharply with the broader market’s recent pullback, as Bitcoin and most altcoins have declined over the past 24 hours amid a notable crypto market downturn. Meanwhile, institutional interest remains strong through figures like Michael Saylor, whose Strategy continues to expand its position despite market volatility. The rejection of Bitcoin from key technical levels around $98,000 signals waning short-term bullish momentum, while ongoing debates about Bitcoin’s role as a payment medium persist, with surveys indicating limited real-world adoption due to merchant acceptance and high transaction fees. Market Sentiment & Implications: Overall sentiment is mixed, with short-term weakness in price reflecting profit-taking and a general risk aversion in the face of recent corrections. Despite heavy institutional accumulation, the broader retail and DeFi sectors are under pressure, contributing to a bearish to neutral market tone. The divergence between strong institutional buying and weak retail activity suggests potential for short-term volatility and a possible setup for a rebound if risk appetite returns. Traders should be cautious of overbought conditions in the Treasury sector and remain vigilant for catalysts that could reignite broader market confidence, such as regulatory clarity or improvements in Bitcoin’s payment infrastructure. Outlook & Catalysts: Key upcoming catalysts include the next major institutional buying signals from Strategy and Saylor, which could provide support if executed at favorable prices, but may also attract scrutiny from regulators. The evolution of Bitcoin’s adoption as a payment asset—potentially driven by merchant network growth and fee reductions—remains a pivotal inflection point for long-term narrative shift. Additionally, upcoming macroeconomic data and regulatory announcements in the US and globally could influence risk appetite. If Bitcoin breaks out of its current consolidation range or if real-world usage increases significantly, both the short-term price action and the broader crypto ecosystem could see renewed momentum.

Real-Time AI Crypto News & Market Sentiment

Stop guessing.

Start knowing.

AI-powered trading signals updated hourly. See what the market is doing before it moves.

What is 1Crypto?

1Crypto is your intelligent cryptocurrency news aggregator, combining real-time updates from 19+ trusted sources with AI-powered analysis. Our platform automatically classifies news sentiment (bullish/bearish/neutral), generates concise summaries, and tracks market-moving events across the crypto ecosystem.

How Our AI Works

Our AI engine processes thousands of articles daily, using advanced language models to analyze sentiment, extract key entities (coins, exchanges, protocols), and identify market-moving news. Each article receives an importance score and sentiment classification to help you focus on what matters most.

Who Is This For?

Whether you're a day trader seeking real-time market signals, a long-term investor tracking fundamentals, or a researcher monitoring industry trends, 1Crypto delivers the insights you need. Our platform serves crypto enthusiasts, fund managers, and anyone seeking data-driven market intelligence.

Frequently Asked Questions

1Crypto is an AI-powered crypto news aggregator that collects real-time news from 19+ trusted sources, analyzes sentiment using local AI models, and surfaces the most important market-moving stories.

Our feed updates every 5-10 minutes with new articles from all sources, while AI analysis (sentiment, summaries) refreshes hourly.

It's a 0-100 index reflecting overall market mood based on AI-analyzed news sentiment. Below 40 = Fear, above 60 = Greed.

Yes, core features (news feed, sentiment, AI analysis) are free. Premium features may be added in the future.

We track the top 20 by market cap (BTC, ETH, SOL, XRP, BNB, ADA, DOGE, etc.) plus major DeFi and Layer-2 tokens.

Yes, use Bookmarks to save articles and Watchlists to follow specific coins, topics, or sources.